Torsten Bell, the Director of RF, commented, “In politics the public finances get a lot of attention. In particular economists focus on the level of government deficit (how much we borrow each year) and debt (our total stock of borrowing built up over the years). But there’s a strong case for reconsidering this approach given changing economics and politics.

“On the politics side it doesn’t really work for a world in which John McDonnell wants big nationalisations and Sajid Javid is desperate to announce as many infrastructure projects as possible. Properly thinking about these policies means focusing on the value of what’s being bought and built, alongside the debt increase to buy or build it. Otherwise we just focus on the mortgage and not enough on what the house is worth.

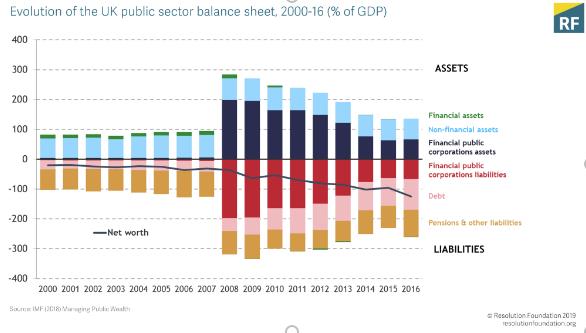

“On the economics side it doesn’t do justice to the explosion in our government balance sheet in recent years, as the chart below spells out. A narrow focus on debt ignores many assets (RBS shares, hospitals, and roads) and wider liabilities (PFI, pensions, and environmental clean-up costs).

I believe there are other assets which might also be included in the analysis, such as the Bank of England’s holdings of our national debt into the assets.

As the International Monetary Fund pointed out in its research, “Once governments understand the size and nature of public assets, they can start managing them more effectively. Potential gains from better asset management are considerable.” https://www.imf.org/en/Publications/FM/Issues/2018/10/04/fiscal-monitor-october-2018

To do this would enable us to separate discussions about investing in roads, railways, social housing, 5G, hospitals and care homes from levels of welfare payments or income taxes, and so be less partisan and with any luck make better progress.

It does also highlight the need for us to recognise the enormity of our future pension liabilities, a subject which will not recede.