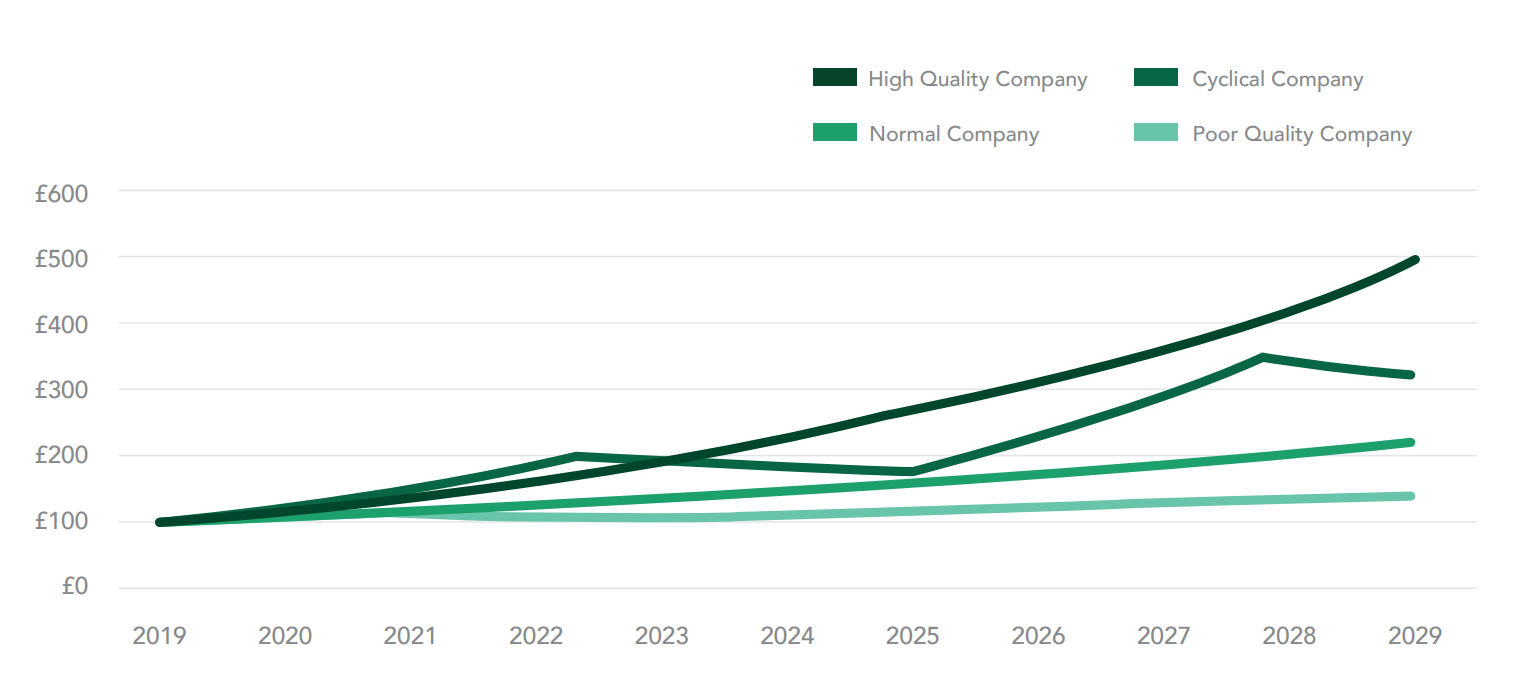

There are many different types of business, and of varying qualities. A key signal of business quality is return on capital. Return on capital is the percentage figure a company earns each year in profits for each pound invested in the business. A poor-quality business will have a persistently low return on capital, perhaps below its cost of capital. The cost of capital is the required return at which the market is prepared to invest, allowing for the risk of the company. A current example of poor-quality businesses would be many UK and European banks.

A cyclical business at buoyant points in their cycle may have a return on capital that is high, followed by periods when the return on capital is low, or even negative, during cyclical troughs. An example would be UK housebuilders. These are not necessarily bad businesses, but management need to be aware of where they are in the cycle so that their business battens down the hatches at the right time.

This is difficult. Management need to be exceptional. Good quality businesses are likely to have high returns on capital – of 15% or more – and be able to earn that return year after year. This means that at 15%, £1 invested at the start of the year is worth £1.15 by the end of that year, and £1.32 by the end of the following year. Many branded consumer goods businesses are

historic examples of companies that have consistently compounded returns at high rates.

Below is a chart depicting the returns available to companies, on the assumption that all profits are reinvested into their business, as opposed to a portion being paid out in dividends to shareholders.

The difficulty in evaluating a business’s quality is in determining how sustainable their return on capital is. How susceptible is the business to the economic climate and competitive forces? Does the market in which they operate have many years of growth ahead? Could they become victim to regulatory or technological disruption? Will management continue to run the business and its finances effectively?

Only by thorough and continuous analysis can answers to these questions, and others, be given with a degree of confidence. In the final article in the series we will discuss how much we are prepared to pay to buy shares when we have discovered a high-quality business.