The chart (Source: Bank of England) shows that the RMB is weaker now than at any time in the last ten years, having reversed the period of strength which followed the financial crisis in 2008. A rising line shows RMB weakness.

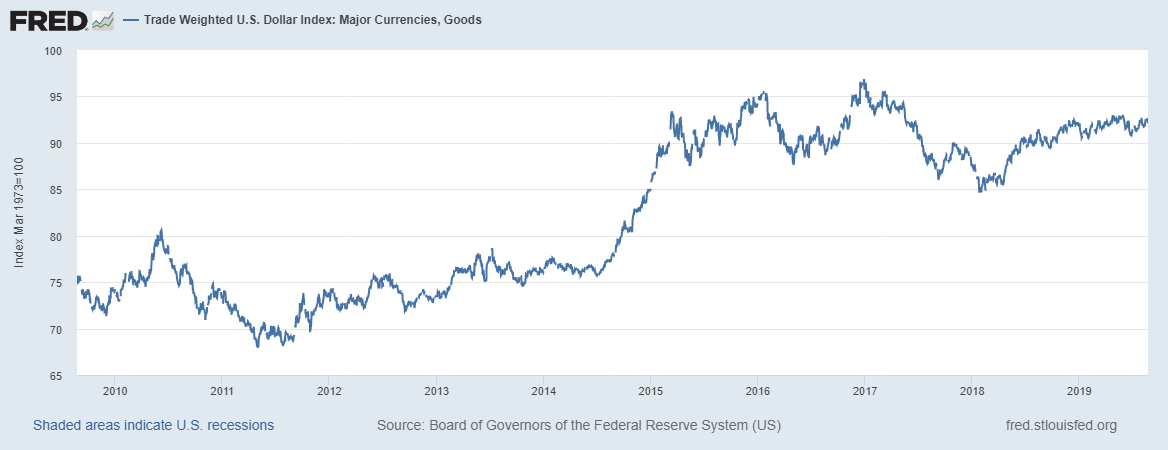

The chart also indicates that the People’s Bank of China (PBoC) managed the stability of the currency very actively in the first five years, but that the RMB has been more subject to market volatility in the latter five years. Over the same period the dollar has been reasonably strong against a basket of other currencies.

This suggests that more is at play than simply the level of the RMB.

“The latest report by International Monetary Fund (IMF) concluded that the exchange rate of the Chinese yuan (RMB) was “broadly in line with medium-term fundamentals”, and the Chinese monetary authority barely intervened in the foreign exchange market.”

Source: http://www.chinadaily.com.cn/a/201908/10/WS5d4eab59a310cf3e3556501f.html

Many people would argue that the relative strength of a currency is related to the performance of its underlying economy. Clearly the trade war initiated by Mr Trump was designed to hurt the Chinese economy, so perhaps that is having an impact.

It is also easy to say that the Chinese would wish to weaken their currency so that goods exported to the US are cheaper, and that this would to some degree compensate for the tariffs being imposed.

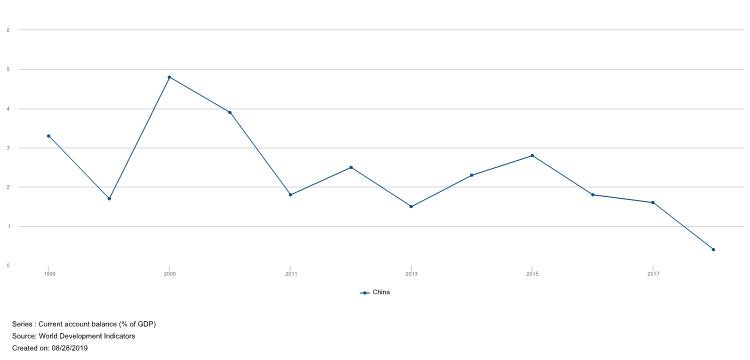

But would China really want a weak currency? Perhaps if it remained an economy driven by export growth. But it doesn’t.

Net exports are now a very small part of China’s GDP. The economy has shifted from being driven by exports and investment to one which is now powered by domestic consumption growth. There would not be much to be gained by weakening the RMB.

However, devaluation would have risks for China both in the form of the cost of servicing dollar denominated debt, and by raising the risk of capital flight, which happened last time the renminbi weakened sharply. Then China had to spend $1 trillion to stabilise the currency. (Source: Benjamin J Cohen: Can America and China avoid a currency war? 8th August 2019)

Equally it is not in Trump’s interests to fail to reach a deal. He needs to show economic success during the run-up to the US elections in 2020, and the economy is already slowing.

It is difficult to see why Trump has picked this fight. But that is equally true of the trade war. Neither country benefits from the hysteria which has been created.

The real issue is geopolitics, and the fact that the US faces no longer being the sole superpower.

A deal at some point before US electioneering starts in earnest looks the most likely outcome.