Typically, this requires a company to be a market leader, and often to be within a sector of the economy which is not only growing but also benefiting from change. This tends to mean that they grow consistently even when times are hard (Growth). Many have found life surprisingly hard this year, but in the main they have done better than more cyclical businesses or those with a weaker financial position (Value). Many are benefiting from the enforced change in consumer habits.

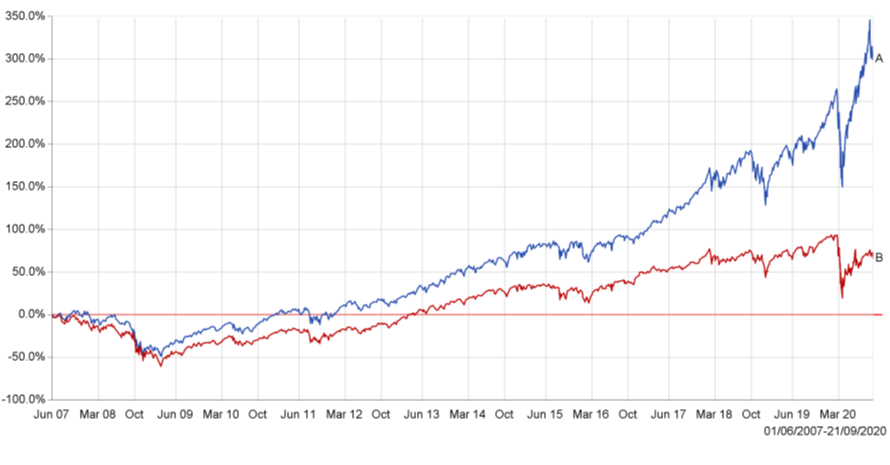

The difference in performance between the two groups has been consistent for many years now, as can be seen in the chart below. The blue line is the Russell 1000 Growth Index and the red line is the Russell 1000 Value index.[i]

Naturally it becomes reasonable to ask whether all the benefits of investing in Growth are well understood, so whether it may be time to invest in Value. If their relative corporate performance was similar this would certainly be a fair question, but it has not been.

My thanks go to T Rowe Price for their analysis of the average financial performance of the companies in these two indices[ii]

| Russell 1000 Indices | ||||

| Revenue | Earnings | Free Cashflow | ||

| Growth 1000 | 46 | 89 | 142 | |

| Value 1000 | 11 | 5 | 16 | |

| Period Analysed: | 1 June 2007 to 30 June 2020 | |||

It is important to recognise that we are in an era of change, and that to invest successfully we should position our portfolios on the right side of change. If one is on the wrong side of change, then a lot of self-help is required to remedy any given company’s problems. The combination of these factors means that a simple concept of “reversion to mean” is inadequate.

Moreover markets tend to underestimate the durability of the returns of strong companies, and to overestimate the durability of businesses whose position is fundamentally disrupted.

This does not mean that quality growth companies will outperform over every shorter time period, but it does improve the probabilities over the longer term. It is also true that not all quality growth companies are valued at the same level at the same time, and thus active management is necessary.

These companies are intrinsically resilient, and resilience deserves to be at a premium in an environment as challenging as the current Covid-impaired one.

[i] Source: FE Analytics

[ii] Sources: T Rowe Price and Factset