There remains uncertainty about the degree to which many sectors and their employees have been scarred by the pandemic, and so the degree to which demand can rebound. It is a question of degree, and I would suggest that precautionary behaviour may constrain it.

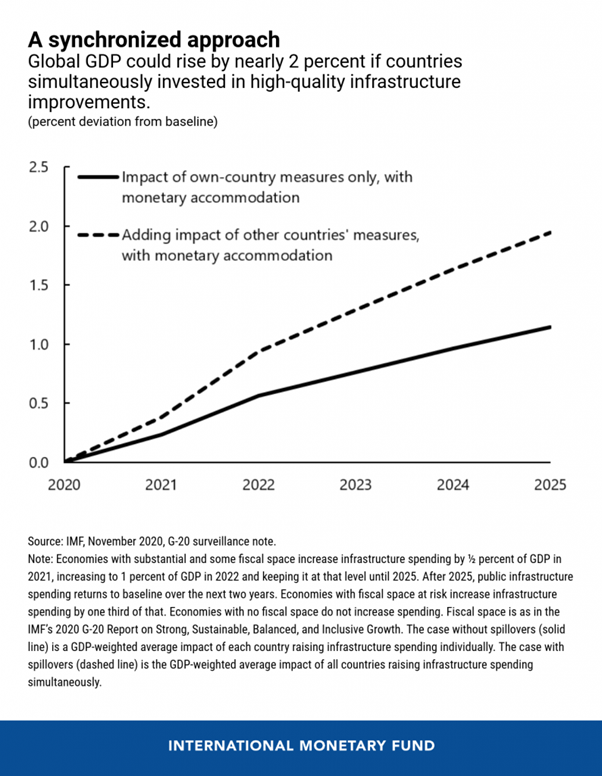

But we can also see another stimulus of global economic activity, in the form of infrastructure investment, and an interesting report from the International Monetary Fund[i] suggests that here the potential is that the sum of the parts may be more stimulative than the parts alone.

They argue that in addition to invigorating growth, such synchronised investment would limit scarring, address climate goals and boost trade linkages. This positive “spill-over” effect could provide an additional boost to global output.

They claim that the spill-overs created by higher demand are particularly impactful when economic conditions are weak and interest rates low.

When economic conditions are strong, higher government spending may push inflation above the central bank’s target and trigger a monetary policy tightening, offsetting some of the initial boost to demand. But when conditions are weak and inflation is well below target, monetary policy is less likely to tighten in response to higher government spending, resulting in higher levels of output. Spare capacity thus amplifies the impact of both domestic public infrastructure spending and the demand that spills over from higher public investment abroad.

Depending upon how the money is spent it may improve the supply side dynamics of national economies, and thus help keep inflation contained.

Additional benefits may occur from specific types of infrastructure spending. For example, green investments would strengthen resilience and allow for a cleaner world for the next generation. Efficient mass transit projects, smart electricity grids, and retrofitting of buildings to enhance energy efficiency could be prioritized. Job-intensive public investment such as infrastructure maintenance or public works that are implemented efficiently are also of the essence.

When policymakers across countries work together and implement high-quality, smart spending on infrastructure, the impact of their individual actions can be amplified and provide further support for all economies.

Everyone would get a bigger bang for their buck.

[i] https://blogs.imf.org/2020/11/24/how-a-collective-infrastructure-push-will-boost-global-growth/?utm_medium=email&utm_source=govdelivery