However, despite a surge in the levels of borrowing in recent years the affordability of it has remained intact – at least for as long as interest rates remain at historically low levels.

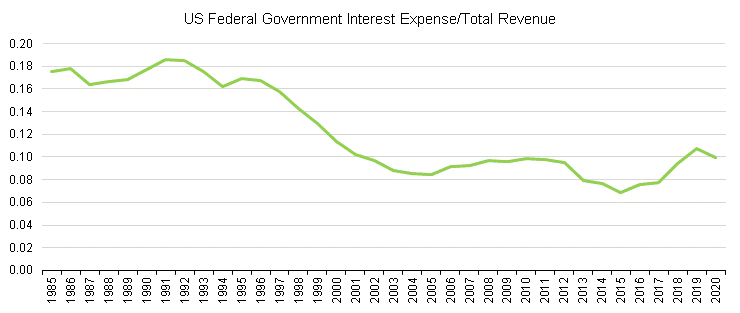

My thanks to Twenty Four Asset Management for this chart of the situation in America, and the one further below, which illustrate this[i]:

The share of national income which is required to make the interest payments is much lower than it was in the 80’s and 90’s.

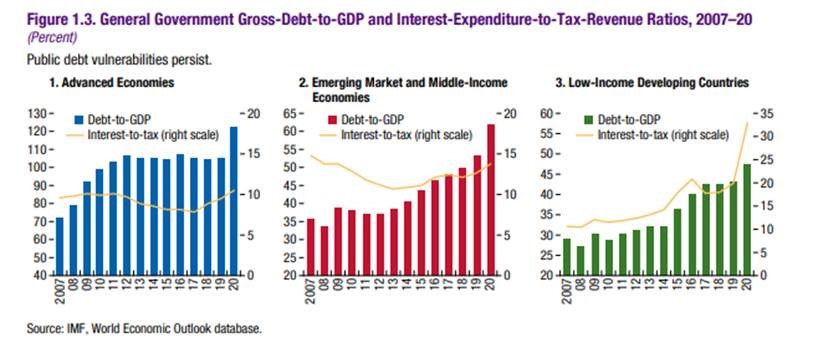

The situation is very similar across both developed and middle-income economies, although financially weaker developing economies may struggle:

This goes some way to explaining why many economists argue that interest rates will remain low for many years yet. Of course, the situation is more complex than that, but it is a pragmatic rather than an ideological view.

It is likely that the debts will be “rolled over” when they fall due, and so the repayment periods will be extended rather than the debts repaid. Interest rates would need to remain low for the affordability to remain intact, and so central banks are likely to remain active buyers of government debt.

The alternatives are not attractive, and in a world which is weary of austerity this scenario gains credence.