During the quarter we sold Knights Group. Knights issued a profit warning in March which was due to a slowdown of corporate work and Omicron during their traditionally busy months of February/March. Whilst we still believe in the regional rollup model, this profit warning highlighted the fixed operational nature of their business (fixed renumeration of employees) which could be susceptible to any economic slowdown.

We deployed some of the cash from the takeover of Sumo into a new holding, Instem. Instem provides integral software solutions to pharmaceutical companies to help them bring new drugs to the market quicker than would normally be the case. It typically takes over 12 years for a drug to go from discovery to the market and over 50% of drugs on the market have been through Instem’s platform during development. We live in a growing/ageing population and the global pandemic is likely to have intensified the pressure on healthcare groups to accelerate and improve the entire drug trial process, which should be positive for Instem.

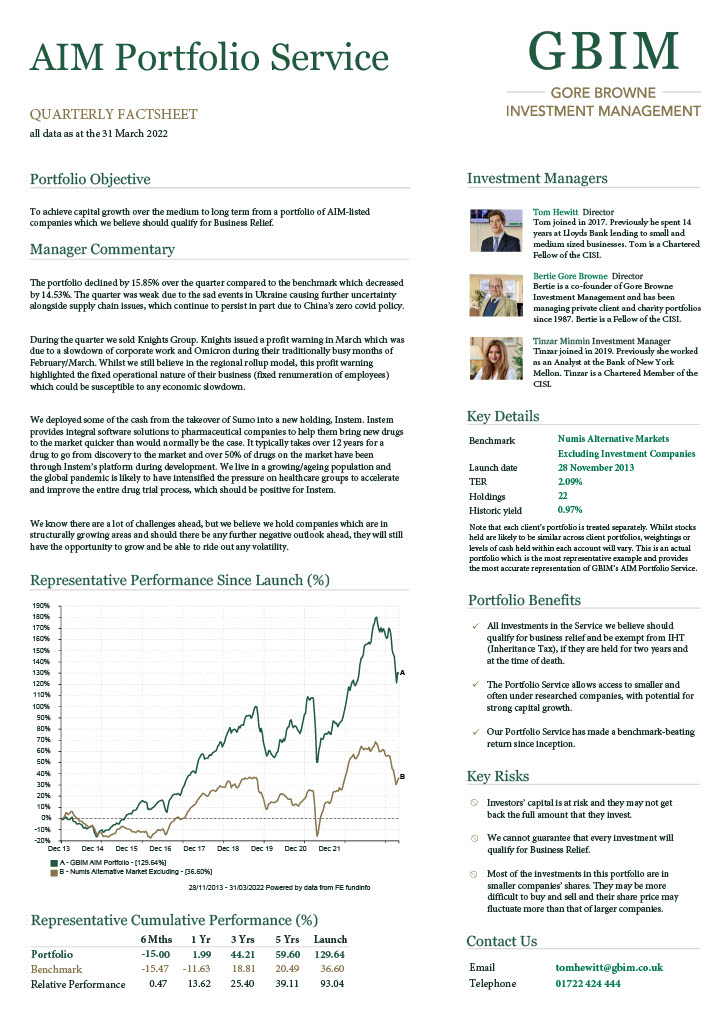

We know there are a lot of challenges ahead, but we believe we hold companies which are in structurally growing areas and should there be any further negative outlook ahead, they will still have the opportunity to grow and be able to ride out any volatility.