As luck would have it, on Friday I was shown some research from the Bank of England which addresses this question[i]. It is slightly out of date (done in March 2021, released in June) and so prior to new variants, ending of furlough, queues for petrol and sundry shortages, but it suggests an increasing disposition to spend. That makes sense if there is a reduced need to feel cautious.

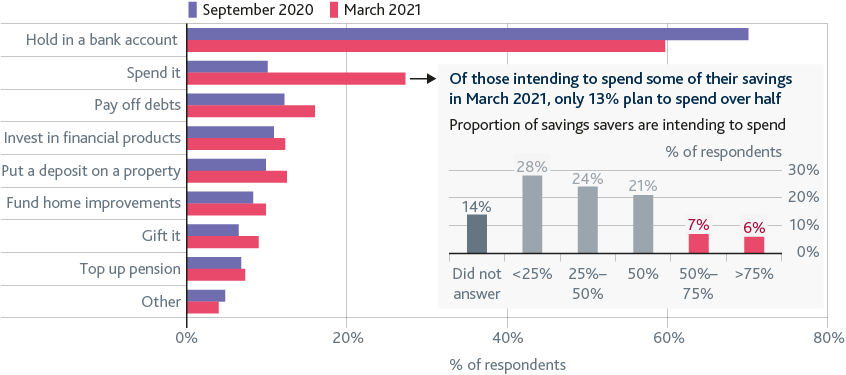

I think it is important to recognise that being keen to spend some of the savings does not mean spending all the savings. This is shown in the chart inset on the right.

It also shows that reducing a bank balance does not necessarily mean “revenge spending”. It may mean paying off debts, adding to pensions and investment, improving the house or getting on the housing ladder.

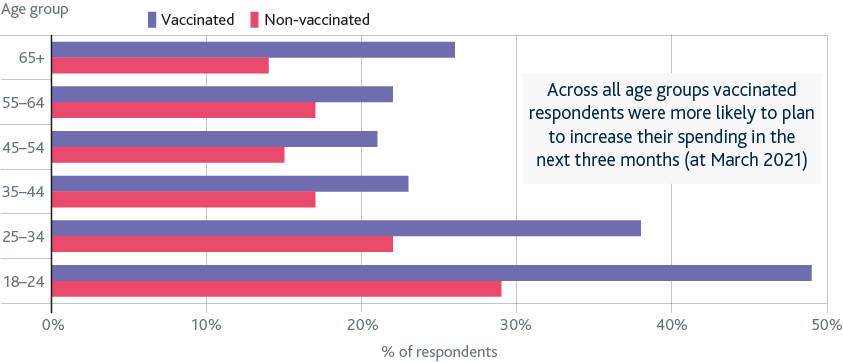

The issue of caution was underlined perhaps by the responses showing that vaccinated people had a higher propensity to spend.

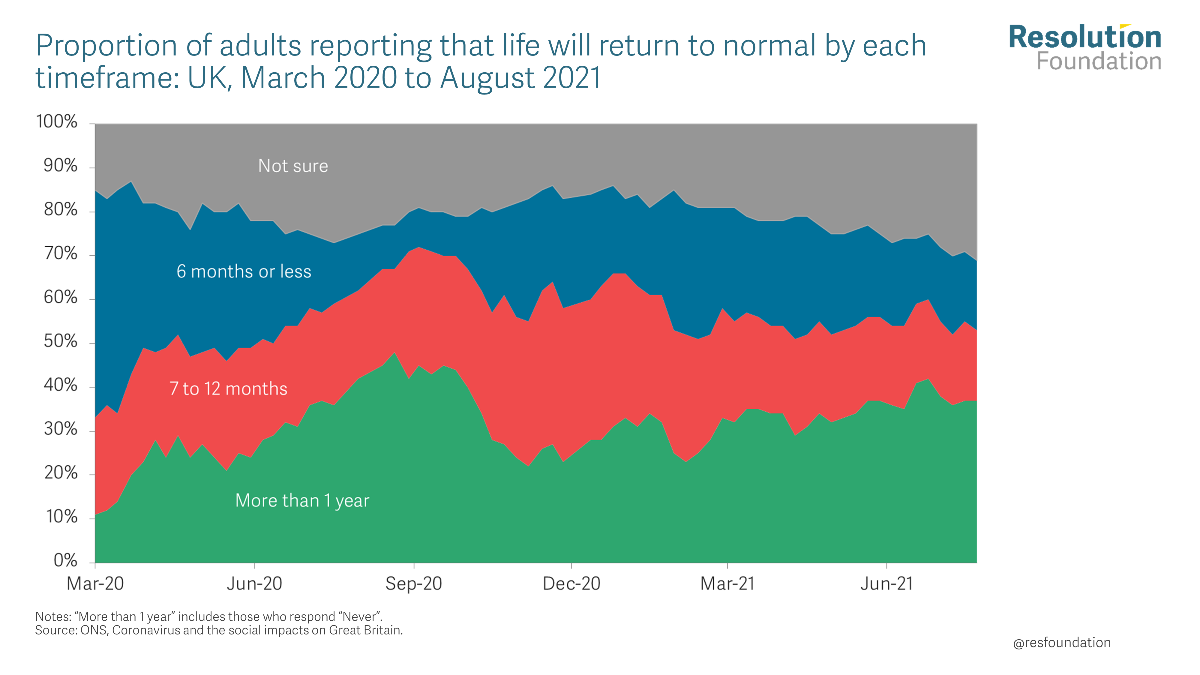

I think the more recent Resolution Foundation research[ii] indicates continuing uncertainty, but both these figures are likely to be volatile for a long time yet.

[i] https://www.bankofengland.co.uk/bank-overground/2021/how-have-households-spending-expectations-changed-since-last-year

[ii] https://www.resolutionfoundation.org/comment/rubbish-regulation-perfect-procurement-and-long-covid/