I had no cash in my pocket having only paid electronically for all other purchases, offline or online, in the last few months. The local village shop, the supermarkets and the petrol station only take electronic payments.

In July 2018, the Access to Cash Review was launched to look at the future of access to cash across the UK. They reported in March 2019[i] that, “Cash is in decline. But Britain is not ready to go cashless, because digital payments don’t yet work for everyone. The consequences to society and individuals of not having a viable way of paying for goods are potentially severe.”

The report was very clear that moving to a cashless society would risk the exclusion of up to 20% of the population, and they made a range of recommendations for the gradual transition towards digital payments.

A year later we are in Covid-19 lockdown. The volume of transactions has fallen dramatically and the share of those done online has soared. When doing face-to-face transactions it is abundantly clear that most retailers do not wish to handle cash, which might carry the virus.

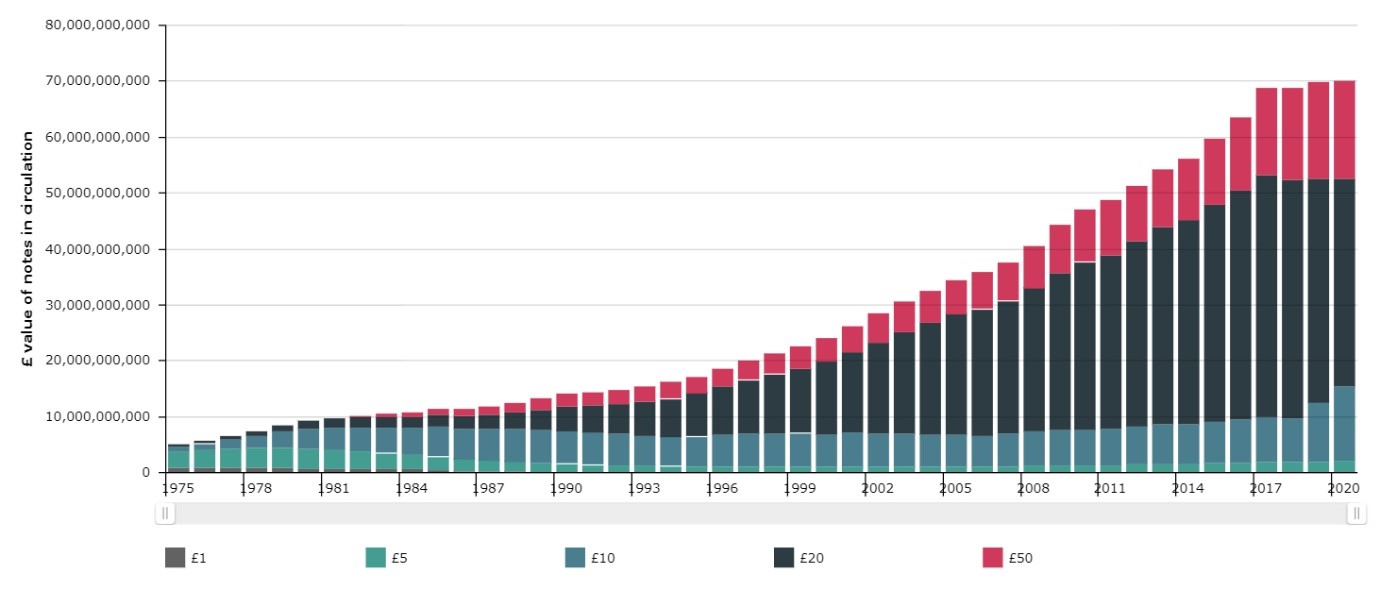

The amount of cash in circulation has continued to grow[ii]:

And the Bank of England supports the findings of the Access to Cash Review, intending to develop a new system for wholesale cash distribution so people who want to use cash to pay for things, can. They have established a Wholesale Distribution Steering Group (WDSG)[iii], but it is yet to publish its recommendations.

It is probably safe to say that they will argue that we should move to “less cash but not cashless”.[iv]

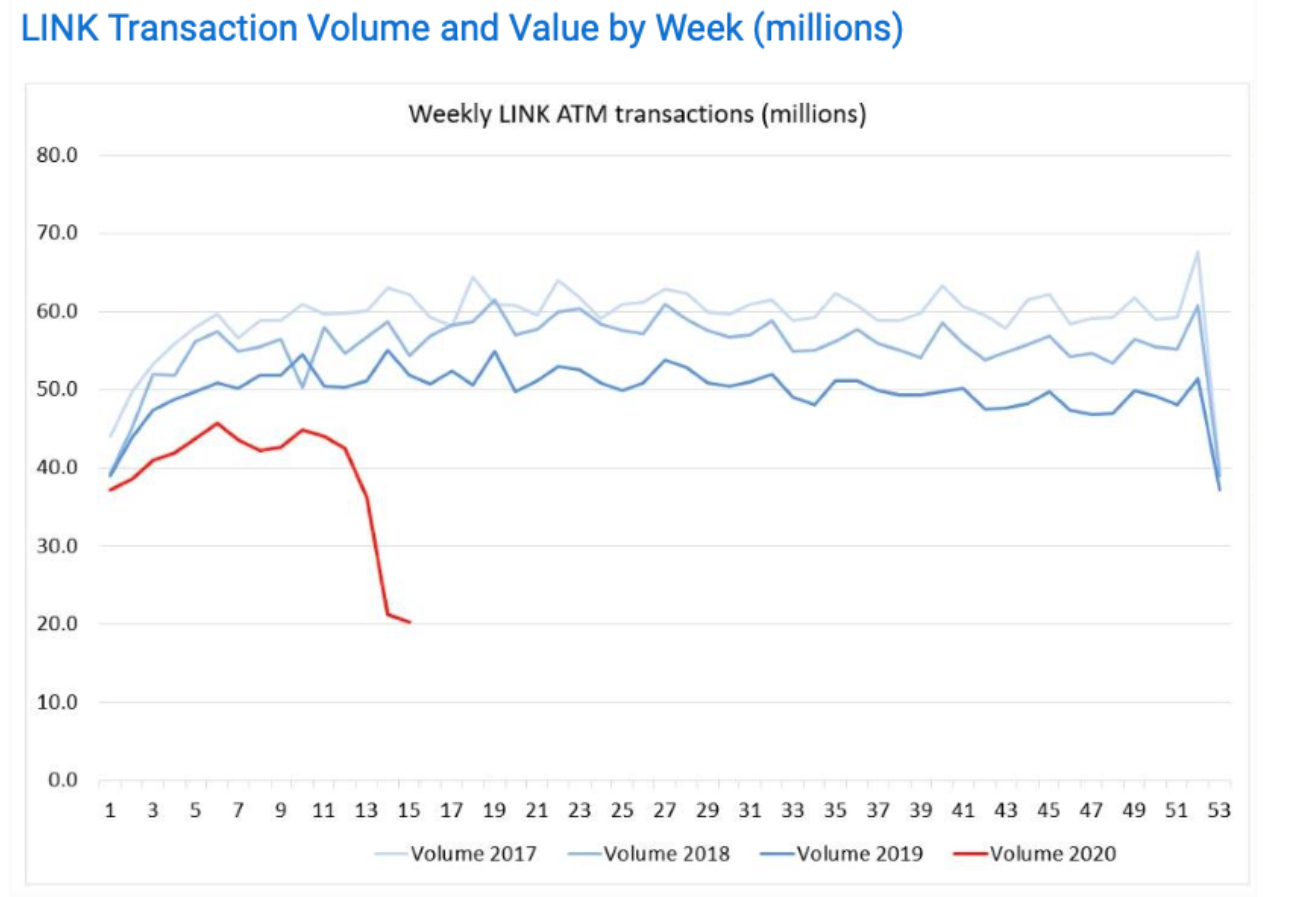

Cash usage has fallen, even prior to the impact of the pandemic, as can be seen from transaction volumes at ATMs[v]:

Source: LINK

On 23rd March, shops and banks agreed to raise the limit for contactless payments from £30 to £45. Mobile phone users could already make contactless payments of more than £30, if the retailer accepts, by holding their phone over the reader and entering their normal card pin on their phone. There is no official limit on the amount a customer can spend when using Apple Pay, but some retailers have their own ceiling.[vi]

The closure of shops, a shift to contactless payments, plus concerns that notes may harbour the virus have contributed to the dramatic decline.

And this is before the introduction of Amazon Go in the UK. Amazon describes Amazon Go as “a new kind of store with no checkout required”. That means, when you shop at Amazon Go, you’ll never have to wait in a queue. The shop works with an Amazon Go application – you enter Amazon Go, take the products you want and, thanks to the app, just leave again.[vii] My colleague James Crarer wrote about Amazon Go previously – https://www.gbim.co.uk/news-insight/the-unintended-consequences-of-innovation/

These factors have certainly accelerated the adoption of the various forms of electronic payment, but there remain 1.5 million people in the UK who are unbanked and who must not be left behind. In the short term, anyone without a bank account will need to physically visit stores and spend cash to make their essential purchases. The move away from physical currency was already well underway and we could see the demise of cash rapidly accelerated. That puts the need to address financial inclusion at the top of banks’ priority list.

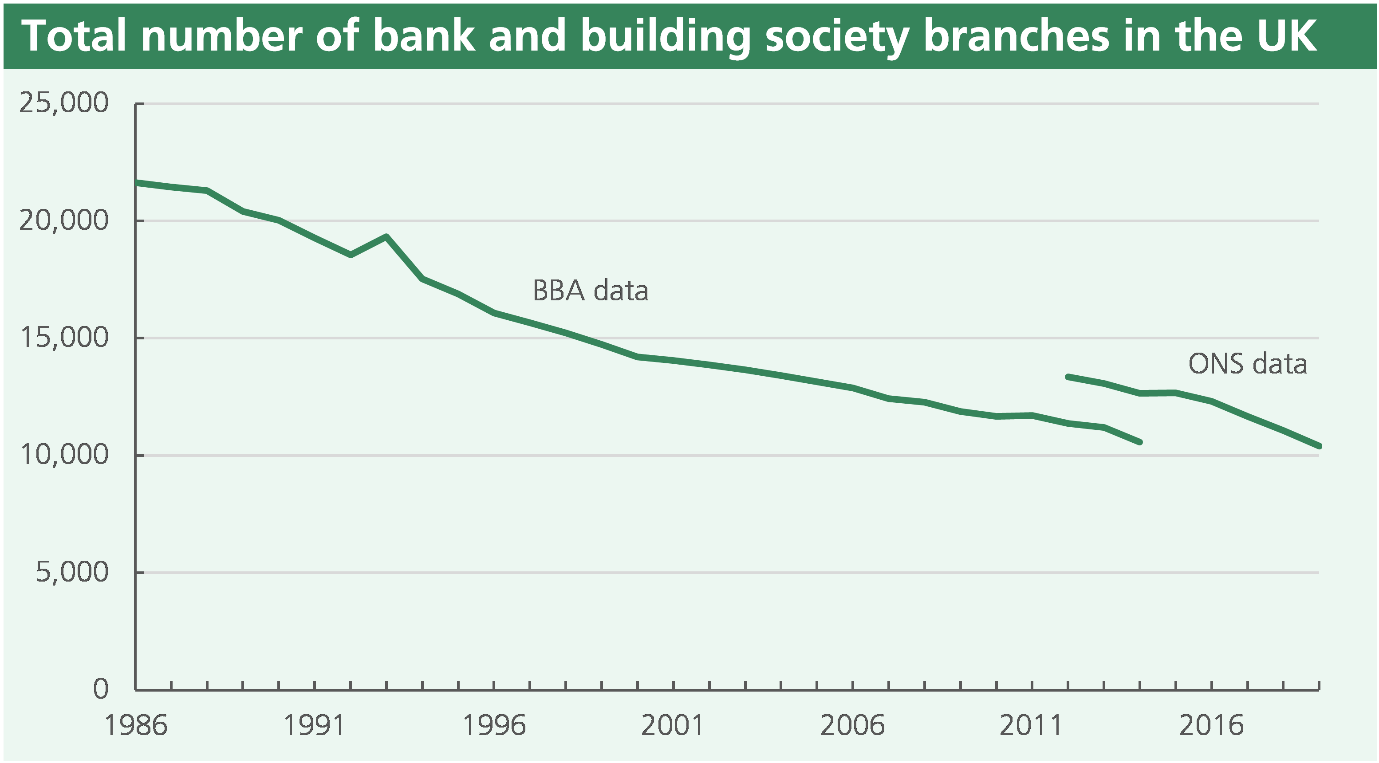

But banks’ profits are already under pressure, and they will wish to accelerate the closure of branches and the removal of free ATMs to cut costs and to respond to cashless trends. Might supermarkets, offering “cash back”, fill the potential void?

Source: House of Commons Library

Fintech companies are making inroads into aspects of our daily finances and, with the payment card companies, are providing new solutions.

Banks remain between a rock and a hard place. Social responsibility on the one hand and competitors, shareholders and staff on the other. They also have to deal with the costs and inefficiency of handling cash and cheques, and businesses are often unhappy about the charges they pay for these.

I can’t see the authorities leaving people dependent upon cash to fend for themselves, but cashless transactions are unlikely to return to pre-Covid levels.

There is a lot riding on the findings of the “Access to Cash Review”, but the direction of travel towards a cashless society seems clear and the trend seems to have become more entrenched. It is not “if”, but “when”.