Earth can be scanned from above through aerial and satellite images, so we can now collect vast amounts of data related to the atmosphere, landforms, and buildings as well forests, deserts, and watercourses. Over a period, that data may provide useful insights into changes of those formations and how they can impact financial value.

The adoption of this interesting area into financial analysis has been named spatial finance.

Spatial finance brings together different types of data, such as images, remote sensing, geographic information systems, and voluntary reporting. It then combines these with the technological advances of more efficient data collection, quicker processing, and algorithms to provide more precise and up-to-date information for those looking to assess Environmental and Climate impact.

Essentially it is the combination of data collection and machine learning. This is not so different, in principle, to how the invention of airplanes meant illustrated images or maps could be updated regularly in WW1 – but is clearly more extensive and complex, and much quicker.

The Spatial Finance Initiative has been established by the Alan Turing Institute, Satellite Applications Catapult, and the Oxford Sustainable Finance Programme to bring together research capabilities in space, data science, and financial services and make them greater than the sum of their parts.

The Initiative was set up to mainstream geospatial capabilities into financial decision-making globally and to promote the development of new spatial finance applications.

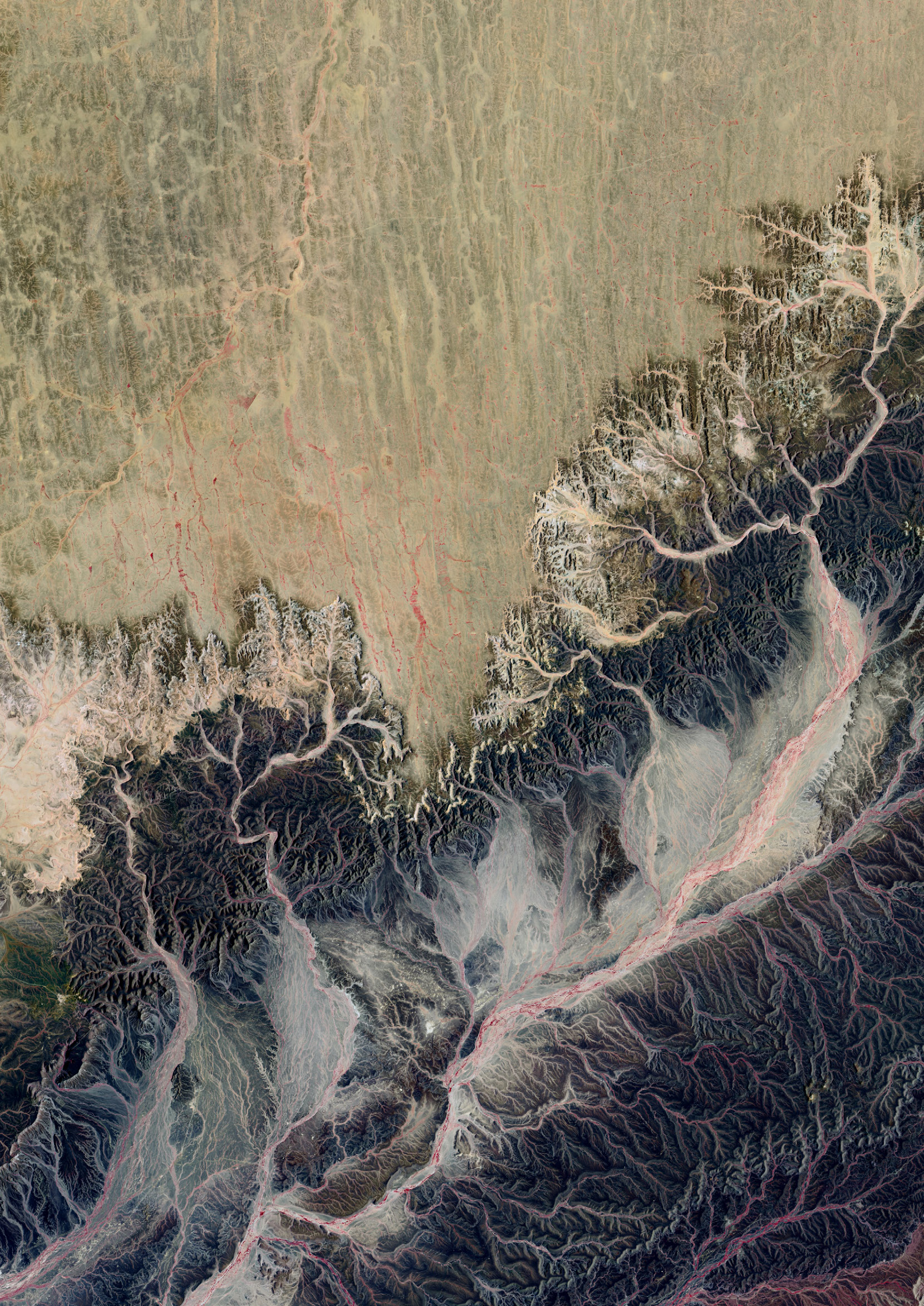

The above image (Nepal) was released by NASA in 2021. It was taken by the Landsat 9 Mission which was designed to monitor earth’s landscapes[1]. Nasa’s Landsat programme started in 1972 so the data and images can show how earth has changed over time.

However, a recent report from the WWF-World Bank[2] has identified ‘three major barriers in the mainstreaming of spatial finance:

Financial theory and practice in investments have already undergone a huge change in the last few years with the integration of Environmental, Social, and Governance factors and one would expect this to be set to continue given the pledges made at the UN Biodiversity Conference (COP15) and United Nations Climate Change Conference (COP26) in 2021.

In theory, 2022 could be a year of meaningful progress when it comes to climate and biodiversity development.

The UK centre for Greening Finance and Investment (CGFI) was established in April 2021. Its purpose is to speed up the adoption of environmental analytics and data by financial institutions.

The Spatial Finance Initiative has been integrated into the CGFI.

Many experts have talked about the need for consistent and accurate data and Spatial Finance could be well-positioned to deliver many of the insights required. For example, a company called Bluefield Technologies, which analyses satellite data, was quickly able to detect and then track the methane leak which occurred in Florida during August 2020.

Spatial finance looks to combine the accurate location of an asset or natural phenomenon and to assess it against certain Environmental, Climate, Social, and Governance data. This is then considered within an economic context.

For example, if one factory produces various goods, then the supply chain and the manufacturing processes for each product need assessing for environmental and social impacts.

If that factory produces those goods for several different companies, then it is increasingly complex and time-consuming to assess the environmental impact for each company. Hence the need for increased efficiency which is being sought by CGFI.

The changes to our ecosystem are vast and often difficult to comprehend so if nothing else we can hope that earth observations and remote sensing, and the financial incentives associated with them, help to support our understanding of those changes and how better to address them.

[1] https://www.nasa.gov/press-release/nasa-launches-new-mission-to-monitor-earth-s-landscapes

[2] https://www.wwf.org.uk/sites/default/files/2020-12/Spatial%20Finance_%20Challenges%20and%20Opportunities_Final.pdf